How To Get Rid Of Debt Tips

Sunday, Aug 16, 2020, 7:20 pm

Loading...

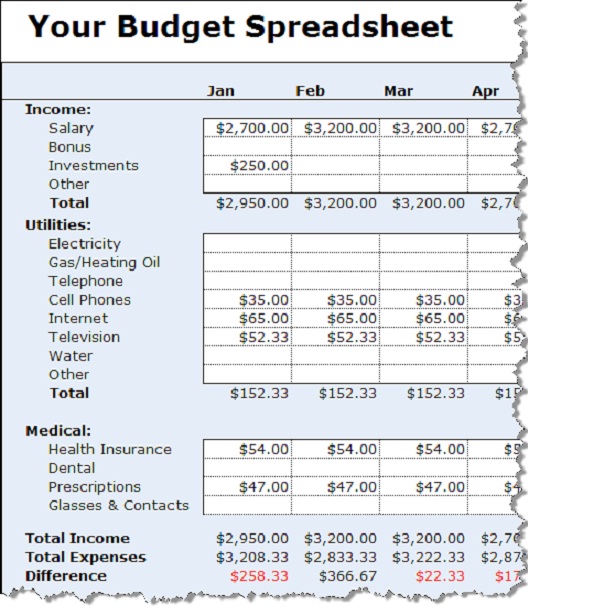

1.Create A Budget

Create a budget and stick to it. Allow yourself a certain amount of money after all bills are paid. Make sure to leave money for food, gas and emergencies too. After that you will feel less guilty if you spend the allotted money on yourself one week and on your significant other the next.

2.Set Up Automatic Payments

Automatic payments work nicely because you never see the money. Soon you forget the money was ever there and your debt gets paid. Late charges can mount up and discontinued services have fees associated with them to be turned back on. It's easy to set up auto payments with most companies.

3.Get Rid Of Car Payments

Get rid of car payments by opting to trade your car in for an older model. You will be surprised at how much you really don't miss your car when you have no more car payment hanging over your head. That's one great way to alleviate debt, by eliminating one large bill and using that money to further reduce another debt.

4.Sell Things

You probably have a lot of things you can sell to make some money. A yard sale is a great idea for cleaning out the garage, basement and attic, while adding some cash to your pocket. You can also sell online on sites such as Craigslist and Ebay. Price items competitively so they sell.

5.Be Frugal

Be frugal and spend wisely. Don't always pay top price for something. Shop around, look for deals and sales, clip coupons, and keep a tight hand on your purse. It is easy to spend when you are out or at work, when the team is going for lunch or you are asked to pitch in or a gift. Manage what you spend.

6.Take On A Second Job

A second job is always helpful in getting out of debt. It may not seem like it pays a lot but it adds up. That cashier job at the supermarket that pays $10 per hour can amount to an extra $200 per week which is $800 per month. That would be a nice payment to knock off some of your debt, wouldn't it?

7.Downsize

Downsize your life. That means getting a cheaper car, not buying designer clothes, cooking instead of going out, buy generic products at the supermarket, clip coupons, wait for movies to come out on DVD rather than going to the movies, go for walks or hikes rather than going out drinking.

Loading...

8.Curb The Impulse Buy

A lot of times purchases are made out of impulse. The packaging and the advertising win you over and you believe you really need it, then when you get it home you realize you probably could have lived without it. When you get that feeling force yourself to wait, telling yourself you will come back the next day. Nine out of ten times you won't.

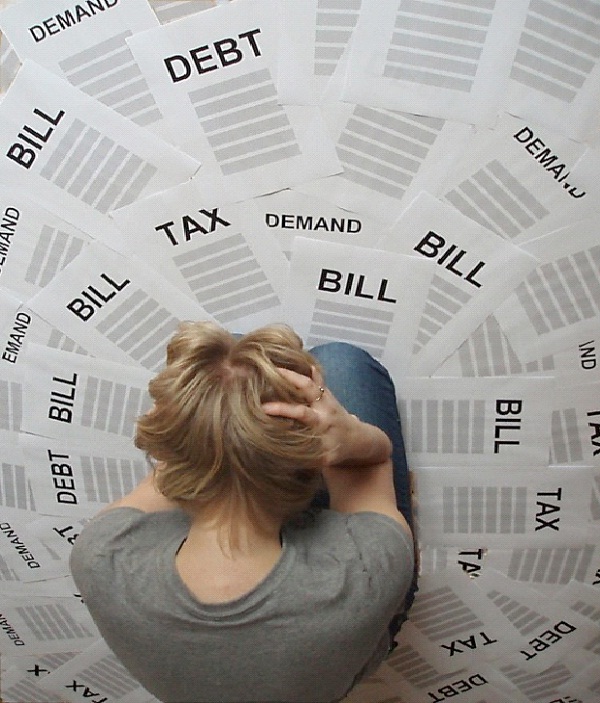

9.Don't Add More Debt

Be aware of adding more debt to your current situation. Cut up those credit cards if you have to, but don't use them. Forget the numbers, and use only the cash you have. The more you can do this the better. If you keep adding debt while trying to get out of debt, you will never dig out of the hole.

Loading...

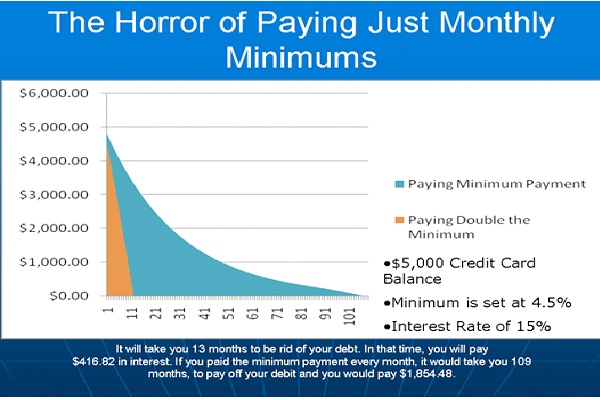

10.Pay More Than Minimum Payment

When paying off debt try to pay more than the minimum payment. Typically if you keep paying just the minimum, you may be just paying off accruing interest and not getting to the actual meat of the balance. The more you can pay the better, and it will lower your debt faster, with you paying less interest over time.

11.Transfer Credit Card Balances

Consolidate all your credit cards onto one. Call all your credit card companies and ask for a special interest rate on a balance transfer. You should do this with loans as well. Having one payment for everything will make it a lot easier to manage, and help you to lower your debt.

Loading...

12.Create An Emergency Fund

When trying to reduce your debt, one of the most important things you can do is to put aside and emergency fund. What usually happens is people use every last cent of their paychecks to pay off their debt and then something happens, like a flat tire, a fender bender, or sick dog, and there's no money to take care of it.

Report

Loading...